I get quite a few emails and in person questions from other up-and-coming photographers curious as to how I knew I was ready to go full-time with my business, and how I go about paying myself, the bills, taxes, and business expenses (you know, all that fun stuff)! Because the truth is – things change A LOT when you go from doing this on the side of a full-time job where you’re investing all your photography income into purchasing gear and building your business, vs. when you’re doing photography full-time and it is what pays the bills all around! It is important before you decide to go full-time that you know you can manage to pay not only your personal bills, but also taxes and business expenses (which really add up)!

So I figured it was about time I finally answered these questions! First though, I need to put a little disclaimer in here to point out that I am not an accountant, a tax professional, or a lawyer. This is just what I do to keep all the wheels turning in our life and our business. I get advice from my accountant, whom I have been with for years, and whom I am in contact with throughout the year to make sure my estimated tax payments are on track – and I advise you do the same! This should just be a starting point for you to wrap your head around how much gross income you need to be bringing home in order to keep your life and business running smoothly and above water!

I should also note before starting any of the money/budget info – that you should have the following bank accounts (at least):

1. Personal checking

2. Personal savings

3. Business checking

4. Business savings

Okay? Okay! 🙂

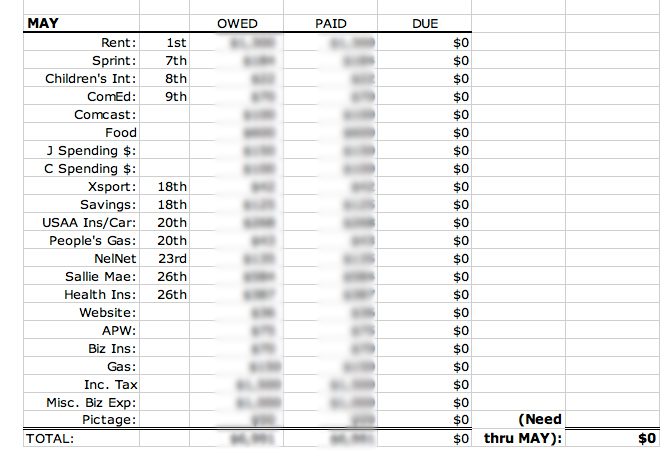

So – after that is taken care of – to start, you need to figure out your monthly expenses. And I mean ALL of them – personal and business. I’m sure there are better ways to do this – but I did it in an Excel spreadsheet.

Here’s an example of what ours now looks like (I have one giant one – including a chart for each month that I keep track of as we go along):

First I went through my business expenses and figured out what I needed each month to pay for those things – including website, blog, hosting fees, business insurance, gas, advertising, gear upkeep/maintenance, client gifts, office supplies… and the list goes ON and ON! 😉 (For the sake of example let’s say we need $2,000 a month to run the business.)

Then I figured out how much money James and I need personally to live off of each month – including personal savings, rent, food, utilities, and spending money for holidays/birthdays/etc. (To make it easy let’s make it a nice round number and say we need $3,000 per month to live off of and pay our bills.)

Then to figure out what I should be setting aside each month for income taxes – I take the amount we need personally and divide it by 2. The resulting number is how much you should set aside for taxes for that month. So if I need $3,000 to pay our bills ($3,000 \ 2 = $1,500), then I need to set aside $1,500 for taxes that month. Which means that essentially our personal gross income is $4,500, with 33% going to income taxes, and 67% (our net income) coming to us. (*Obviously consult your accountant before determining this figure – this is just an estimation! I’ve heard of some people setting aside more for taxes… so make sure you figure out what is right for you depending on the state you reside in!)

All of the information above leaves us with the gross income we need to make per month total just to stay afloat:

$3,000 personal

$1,500 income taxes

$2,000 business expenses

= $6,500 gross income

So we’ve figured out we need $6,500 per month, or $78,000 per year to sustain our lifestyle and run our business.

Logistically speaking – this is how it works with the separate bank accounts….

All income we make goes straight into our business checking account. Then at the start of each month I transfer the amount for income taxes to my business savings account, and write a check to myself (from my business checking account) for the amount we need each month to pay our personal bills. All other business expenses are paid for using my business checking account/debit card, which I have tied to a Mint.com account which tracks my spending each month so I can see exactly how and where I’m spending my business money, as well as itemize each transaction so that at the end of the year I have it all broken down into categories to give to my account for tax purposes.

Once you have this figured out – then you can make a separate Excel spreadsheet tracking the shoots and weddings you book per month so you know when and how much money is coming in. That’ll allow you to see your expected gross income for each month (as well as the entire year), and will tell you how much more you need to book in order to make it through the month/year.

Does this make sense? I’m afraid it makes NO SENSE because numbers and budgets and all of this are confusing! Basically – this is the way to help you figure out your bottom line… what you MUST make over the course of a year to make sure you can stay afloat with your life and business.

Please feel free to write me an email to ask me any questions or comment below and I’ll do my best to answer, or if necessary – refer you to a professional who has an even better answer! Like I said – this is just a starting point to figure out what you should be bringing in GROSS each month (or for the full year) so you can help determine when you’re ready to go full-time and make this thing happen! 🙂

I hope this helped even one of you a *little* bit and then I’ll feel this was worthwhile! 😉